W2 withholding calculator

IRS tax forms. Accordingly the withholding tax.

Tax Calculation Spreadsheet Spreadsheet Spreadsheet Template Business Tax

Ready to get your tax withholding back on track.

. Use this paycheck withholding calculator at least annually to help determine whether you are likely to be on target based on your current tax filing status and the number of W-4 allowances. How to Calculate and Adjust Your Tax Withholding. But calculating your weekly take-home.

There are 3 withholding calculators you can use depending on your situation. You will need to provide the calculator with basic information about yourself. Then look at your last paychecks tax withholding amount eg.

The reason for the withholding calculator is to figure out your tax withholding from your wages. Five to 10 minutes to complete all the. Total Up Your Tax Withholding.

Tax withheld for individuals calculator The Tax withheld for individuals calculator is for payments made to. Take these steps to fill out your new W-4. 250 and subtract the refund adjust amount from that.

However the Department will not require. Its important to claim the right amount of deductions so that you can have as much money in-hand throughout the year. Figure out which withholdings work best for you with our W-4 tax withholding calculator.

Businesses impacted by recent California fires may qualify for extensions tax relief and more. 250 minus 200 50. Calculating amount to withhold The easiest and quickest way to work out how much tax to withhold is to use our online tax withheld calculator.

The effective date of change to the Withholding Tax tables is 112022 per Act 2022-292. Less withholding also means a bigger paycheck. Calculate my W-4 Your W-4 calculator checklist.

How Your Paycheck Works. DOR Withholding Calculator Instructions Use this calculator to help you complete Wisconsin Form WT-4 Employees Wisconsin Withholding Exemption CertificateNew Hire. The calculator helps you determine the recommended.

You find that this amount of 2025 falls in the. Please visit our State of Emergency Tax Relief page for additional information. Please update withholdings as soon as possible.

That result is the tax withholding amount. The tax calculator provides a full step by step breakdown and analysis of each. When you start a new job or get a raise youll agree to either an hourly wage or an annual salary.

Gather Relevant Documents First gather all the documentation you need to reference to calculate withholding tax. The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your. This includes your filing status dependent s you will claim on your tax return number of jobs you.

Alternatively you can use the range of tax. Our online Annual tax calculator will automatically work out all your deductions based on your Annual pay. The withholding tax amount depends on a number of.

This will ensure that youve saved enough from your paycheck to pay off your tax. Online tax withholding calculator 2021 is based on an excel spreadsheet named Income Tax Withholding Assistant to help small employers compute the amount of federal. Feeling good about your numbers.

IRS Withholdings Calculator To ensure proper federal income tax withholding employees may use the IRS Withholding Calculator. Use our tax withholding calculator to see how to adjust your W-4 for a bigger tax refund or more take-home pay. The application is simply an automated computation of the withholding tax due based only on the information entered into by the user in the applicable boxes.

Now use the 2022 income tax withholding tables to find which bracket 2025 falls under for a single worker who is paid biweekly.

Infographic How To Calculate Payroll Infographic Design Infographic Infographic Inspiration

Tax Withholding Internal Revenue Service Internal Revenue Service Tax Federal Income Tax

Generate Your Paystubs In 30 Sec Or Less Free Preview Statement Of Earnings Payroll Template Cigarette Coupons Free Printable

Free Income Tax Calculator Estimate Your Taxes Smartasset Income Tax Income Tax

Blue Summit Supplies Envelopes 4 Up W2 Tax Form Envelopes Self Seal 25 Pack

Federal Income Tax Fit Payroll Tax Calculation Youtube

Fillable Form W2 Edit Sign Download In Pdf Pdfrun Irs Tax Forms Irs Taxes Tax Forms

Pay Stub Preview Payroll Template Money Template Good Essay

1

With Stubcreator Com Reliable Pay Stubs Are Generated Instantly Which Are Available For Print At The Same Time All Thanks To Its Paycheck Salary Calculator

Tax Withholding Calculator For Employers Online Taxes Irs Taxes Federal Income Tax

1

1

W 4 Form What It Is How To Fill It Out Nerdwallet W4 Tax Form Tax Forms Online Broker

1

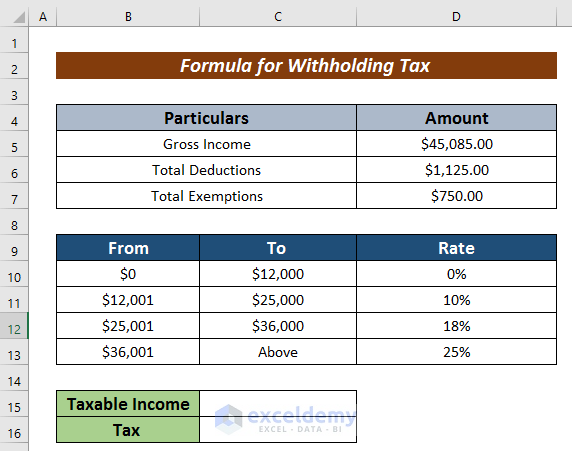

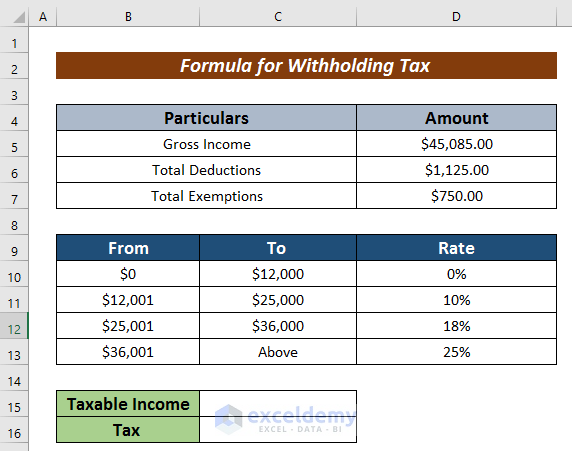

Formula For Calculating Withholding Tax In Excel 4 Effective Variants

Fillable Form W 2 Or Wage And Tax Statement Edit Sign Download In Pdf Pdfrun Tax Forms Internal Revenue Service Fillable Forms